Feed: CNN.com - WORLD

Posted on: Wednesday, November 09, 2011 3:14 PM

Author: CNN.com - WORLD

Subject: What's next for Italy?

Europe's financial crisis claimed its second scalp in three days when Italy's Silvio Berlusconi announced he will resign. What happens next, and is there a way out for Italy? |

Will spiraling borrowing costs sink Italy?

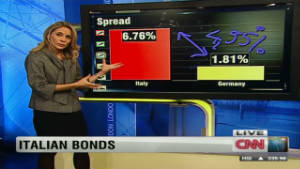

- Italy's bond yields have passed the dangerous 7% threshold

- Bond yields represent investor confidence in a country's ability to repay its debt

- Prime Minister Silvio Berlusconi announced he will resign following the passage of austerity measures

- With a debt pile of nearly 2 trillion euros, Italy is seen as too big for Europe to bail out

(CNN) -- Europe's financial crisis claimed its second scalp in three days when Italy's Silvio Berlusconi announced he will step down after parliament approves new austerity measures in an effort to stave off economic collapse.

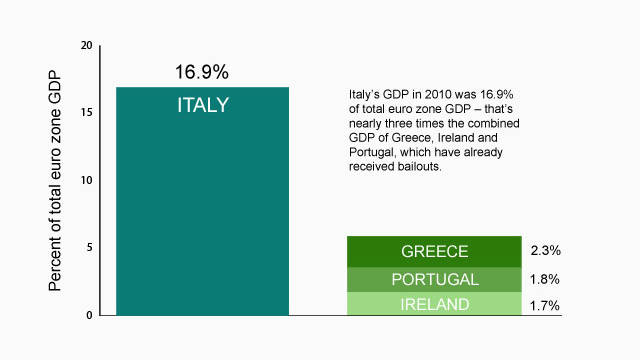

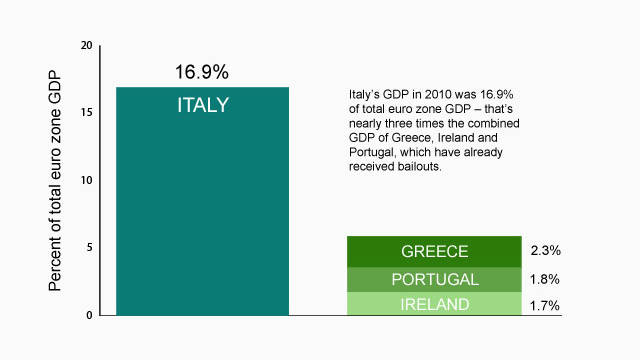

The scandal-plagued prime minister will follow his Greek counterpart George Papandreou into early retirement as fears grow that Italy, the eurozone's third largest economy, may default on its debt.

Italy has failed to implement austerity measures designed to reduce its mammoth â'¬1.9 trillion debt load -- nearly six times that of Greece -- and the cost to the country of borrowing more money to pay off that debt is spiraling out of control.

While no one knows yet whether Italy will default, analysts say that the country is vastly too big to bail out -- and that the consequences for the world economy of a default would be a disaster.

What happens next?

Much like Greek premier Papandreou, Berlusconi said he will not resign until the government passes harsh austerity measures recommended by eurozone leaders aimed at trimming Italy's debt.

Bond markets react to Italy news

Bond markets react to Italy news  Why Italy is too big to fail

Why Italy is too big to fail  Why Italy is too big to fail

Why Italy is too big to failThe next step is for the Italian parliament to pass the measures -- which include tax rises and an increase in the retirement age -- possibly as soon as the end of the month.

Berlusconi will then step down and President Giorgio Napolitano will decide whether to form a government or call for elections.

While Berlusconi favors elections soon because he believes his party can win them, many opposition members and European leaders would like to see an interim government in place that can quickly implement austerity measures in order to reassure global markets and restore confidence in the country.

No one is a fan of uncertainty, and no one is going to invest in a debt-ridden country without a plan for recovery -- much less one without a function government -- so Italy's short-term plan will be to get these austerity measures passed, see Berlusconi off, and hold new elections so at least international lenders will know who they're dealing with.

Check out CNN's interactive map of European debt at a glance

What's wrong with Italy?

The basic problem is that it's becoming prohibitively expensive for Italy to borrow money to finance its debt -- a problem rooted in investor confidence in the debt-laden country.

With a defunct government and a shrinking economy, Italy is finding it increasingly difficult to find people willing to lend it money in order to reduce its mammoth â'¬1.9 trillion debt load, which is nearly six times that of Greece.

The less confidence there is in a country, the higher the bond yields, or rate, that country will have to pay in order to secure more money. Right now confidence in Italy is at a euro-era low, which means Italy is paying more than ever to finance its debt.

What is a bond yield?

A bond yield is basically another term for the rate Italy has to pay to lenders who buy its government bonds. The 10-year government bond is the standard bond used to measure the relative interest rates from country to country.

Italy faces uncertain future

Italy faces uncertain future A government raises money to pay its bills by selling these bonds -- so the higher the yield or rate, the more it costs Italy to borrow money in order to pay its debts.

Italy's 10-year bond yield hit a staggering record high of 7.3% on Wednesday morning; by contrast, the bond yield for Germany -- a relatively healthy economy -- closed at 1.8% on Tuesday night.

Italy will already have to borrow at least â'¬300 billion -- nearly the total Greece owes to lenders -- next year alone to pay off maturing debts, and the worry is that the skyrocketing interest rates on Italian bonds may soon make it too expensive for the country to continue borrowing money.

Why are Italy's bond yields so high?

Bond yields are driven by confidence and based on supply and demand.

The more confident investors are in the health of the Italian economy, the more government bonds, or sovereign debt, the investors will buy.

The more bonds that are being bought, the lower the rates will be on the bonds -- meaning Italy can borrow money to pay its bills at relatively cheap rates.

When confidence in an economy drops, however, less investors are willing to invest money in that country's bonds, which is precisely what has happened in Italy.

Now no one wants to buy Italy's bonds because no one trusts that they will be able to pay off long-term debt based on current economic projections.

Why is a 7% yield considered the point of no return?

Greece, Ireland and Portugal were all forced to seek bailouts once their bond yields surpassed and remained above the 7% mark for an extended period of time.

Italy: Recipe for disaster?

Italy: Recipe for disaster? While there is nothing about the 7% figure that automatically triggers a bailout -- something that would be impossible in Italy's case anyway, as Europe simply cannot afford to bail out the country -- experts do see the rate as difficult to overcome.

Greece, Ireland and Portugal all needed bailouts within two months of their bond yields breaching and then remaining above 7%.

The recent high yields are particularly concerning because the European Central Bank has been buying Italian bonds since the start of August in an effort to create a sort of false demand, which would then drive the rate down to a manageable level. That has not worked, but it could be a lot worse had the ECB not taken the action at all.

How can Italy get out of this mess?

Italy will default on its debt if it doesn't figure out a way to get its bond yields down to a manageable level.

The yields won't budge until Italian lawmakers take concrete steps to reassure international lenders that the country is a safe bet.

"Italy will not be out of the heat of bond markets until a solid and stable government actually implements austerity and undertakes reforms with strong credible leadership," said Jan Randolph, head of sovereign risk at IHS Global Insight.

Even if they pass these the austerity proposals, some economists fear Italy will still drown in debt if it doesn't develop more drastic measures.

The ECB should also increase its purchasing of Italian bonds in order to make it cheaper for Italy to raise money, according to Barry Eichengreen, an economist at the University of California, Berkeley.

"Unless yields on those bonds fall to German levels, there is no way that Italy's debt arithmetic can be made to add up," he wrote.

No comments:

Post a Comment